What does the next great banking service look like

Why your customer’s needs, not competitors or the promise of super-apps, should shape retail banking innovation.

Banks who want to compete must think bigger than shiny new apps—they need to integrate themselves into the day-to-day lives of their customers, with frequent touch points that become as ingrained as grabbing a daily coffee or tapping onto public transport. Simply, legacy retail banks need to find new ways to stay relevant.

Apple Wallet's new open banking feature allows people to check their transactions and balances at a swipe—removing the need for them to log into online banking services and reducing the potential for banks to sell products and services. This should serve as a wake-up call for retail banks, a worrying next step in a rapidly diversifying personal finance landscape.

The temptation can be to look at the latest trending technology and start there. Or to copy Fintechs or direct competitors. The innovation for innovation’s sake approach is doomed to fail, and many legacy banks have already felt the sting of underwhelming transformation—those in the industry will recall stories of features that were never used and quietly shut down.

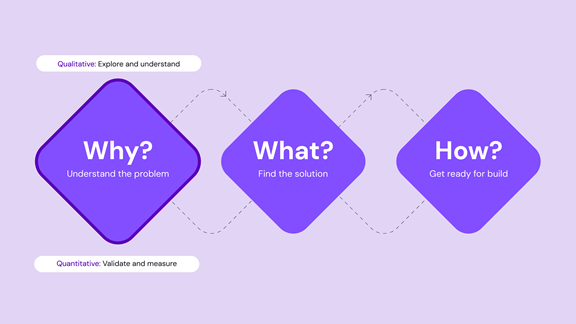

Financial services leaders must avoid the technology hype trap and use consumer insights to drive meaningful product development. Here are some of the ways they can amplify transformation success.