How AI holds the key to a robo-advisory reboot

Can GenAI revive robo-advising?

“Robo-advice” is a clichéd and overused term that has received a fair share of criticism in the past.

The first robo-advice proposition was launched in the UK in 2011, more than a decade ago, but it was back in 2016 and 2017 when robo-advising hit the pinnacle of the hype cycle. During that time, a mass of digital wealth robo-advisor offerings hit the market promising to democratise access to wealth management services for the mass market—who don’t qualify for traditional wealth management services.

But the robo-advice experience was disappointing and the hype short-lived. By 2019, 1 in 4 robo-advisors had shuttered, including robo-advisors launched by big names like UBS, Investec, and ABN Amro.

Then, during the pandemic, there was an explosion in retail investing as many hunkered down and took up trading from their armchairs. As we navigate the post-pandemic environment, we find ourselves in what’s been described as a 'once-in-a-career upheaval’ for the wealth and investment industry:

- Inflation, market volatility, and interest rates are huge concerns for investors and customers.

- Customer demand is changing; demand for retail trading is down, demand for ETFs is up, as is a preference for ESG investments.

- The transfer of wealth to a digital-first generation is happening.

What’s more, in November 2022, GenAI entered the public consciousness of the masses with the launch of OpenAI’s ChatGPT.

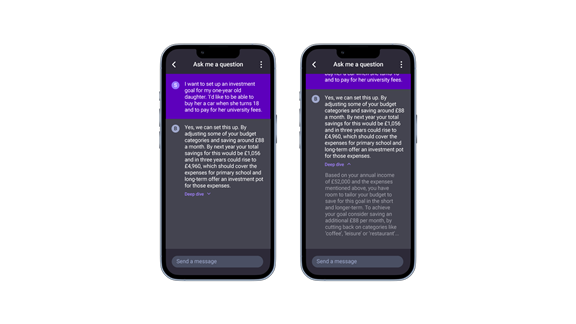

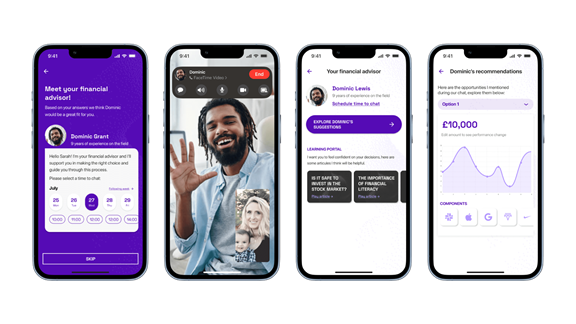

There has been a lot of ink spilled already on what the possibilities and opportunities for GenAI are across different industries. When it comes to wealth and investments for the masses, I believe that the adoption of GenAI is an inflection point for robo-advisor propositions - one that will see robo-advisors win new customers by feeling like a premium service, retain those customers by helping them to achieve their goals, and become sustainable by capturing a larger portion of customers investments.