The notion of the mobile wallet is on the radar of traditional financial services organisations, the largest retailers, and the most innovative tech companies. Despite years of investment, which has seen almost every business race to add the ‘Pay’ suffix to the end of its name, we’ve seen few real successes. As well as needing to take a different approach to making their wallets work, at Kin + Carta we think most businesses should be asking themselves whether they really need a mobile wallet at all.

Does your business really need a mobile wallet system?

So what is a mobile wallet?

A wallet describes a range of propositions for storing and using payments information digitally. Many also include things closely linked to the payment process e.g. loyalty cards or digital I.D.

Digital doesn’t mean they're only useful for online transactions - wallets like Apple and Android Pay use phone embedded NFC technology to support physical retail transactions. WeChat Pay uses QR codes, while merchant wallets like Starbucks or Uber use stored card details to enable ‘online-to-offline’ transactions.

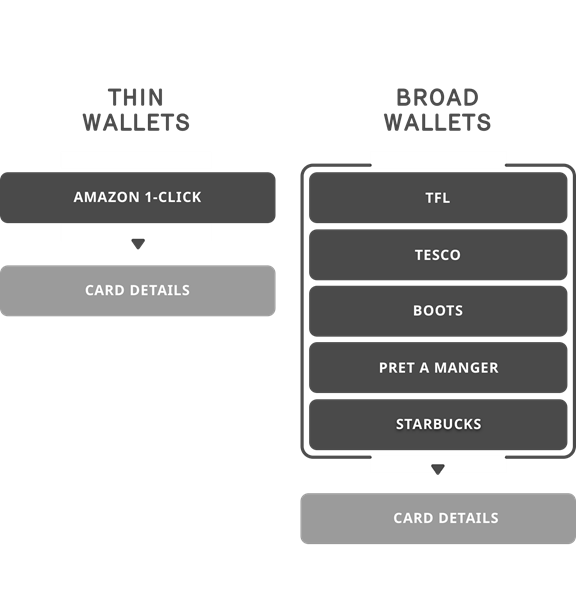

We can categorise wallets based on acceptance. Thin wallets, such as Amazon 1-Click, are built and accepted by a single merchant and store payment details to reduce friction in the checkout experience. Broad wallets on the other hand, such as Apple Pay, are developed by third parties to provide consumers with a digital means of paying at a wide range of retailers.

Why are wallets on everyone's radar?

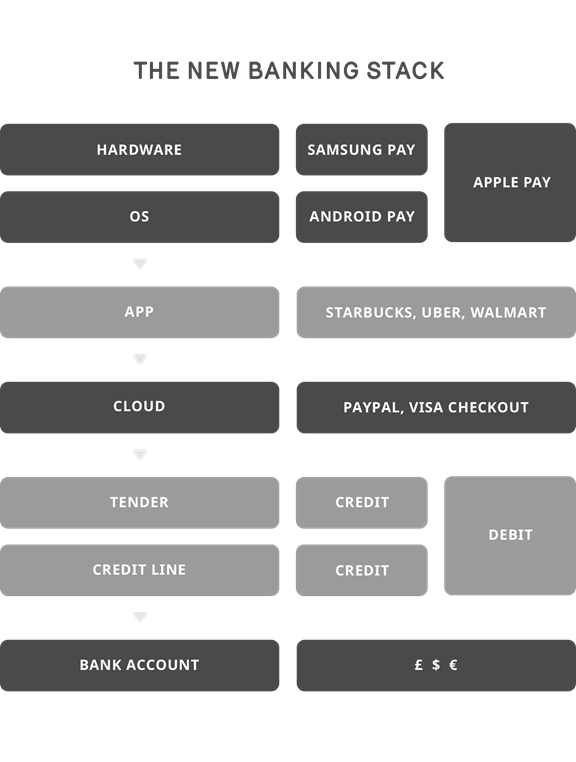

The power of mobile is creating brand new opportunities for payments providers to own the customer relationship.

The smartphone is increasingly becoming the main portal for consumers to conduct their financial affairs. Technology is pushing the opportunity to own the customer relationship further up the stack, and away from the banks that have traditionally held the money.

The retail environment is also undergoing big changes, with customers carrying around a device through which they can find, compare and pay for goods and services. With customer expectations set by their best digital experiences, web and mobile technologies are breaking traditional retailer lock ins and accelerating adoption/abandonment cycles.

What do wallets actually do for us?

Wallets deliver valuable outcomes to users, but there’s a lot of strong alternative choices in the market for consumers and businesses.

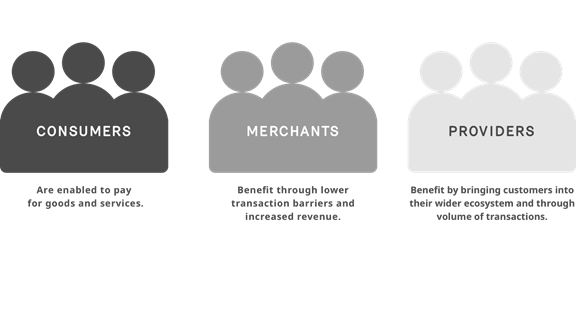

Wallets address core outcomes for three main groups:

Meeting the needs of all these participants is challenging, particularly because innovations like contactless payments or card-on-file capabilities meet consumer and merchant outcomes very well.

The challenge of making successful wallets

Making wallets that work has been challenging for many entrants. Wallets like CurrentC and V.Me have failed to get off the ground, despite the backing of some of the world's largest companies. Even OS default players like Apple have struggled, with Apple Pay only being used in ~4% of eligible transactions.

To help build successful wallets, we’ve come up with four key questions businesses should be asking themselves when they’re designing how their business model should work:

- Are we offering customers more value than alternatives by meeting their outcomes better?

Developing a good proposition begins with understanding how your solution will meet the needs of your customers. Providing compelling customer value, above the alternatives, is the critical element in driving wallet adoption.

It’s important to remember that value is contextual. Successes like WeChat Pay have provided a radically superior alternative to cash, but other wallets that compete against the convenience of card payments have struggled.

Being the core enabler of a strong overall value proposition also works for thin wallets. Starbucks offers convenience through ‘order-ahead and pay’, allowing customers to skip the line and receive tangible rewards in exchange for loyalty. Saving a minute of queuing is valuable in experiences like this, where the total time is mere minutes. A proposition that only saves a single minute of queuing in an hour long shopping experience, however, is nowhere near as valuable.

- Is our potential marketing big enough?

A mobile wallet system needs to launch into markets with enough customers, merchants and transactions. Without the opportunity for frequent, repeat usage, new customer habits won’t develop. There needs to be a critical mass of potential transactions where the wallet can add value to build consumer engagement. Repeatable purchases such as coffee or quick service restaurants are ideal use cases. Commodity products make loyalty schemes a bigger part of buying behaviour, and shorter overall purchases make time-saving valuable.

- Can we attract, onboard and scale up our customer base?

Adding a card to a virtual wallet can be much harder than putting plastic into a real one. Having a stronger onboarding experience with quick, straightforward registration makes it easy to move users down the funnel. Extensive marketing efforts to raise customer awareness and encourage activation are also important. Offering incentives to complete registration, not just for usage, provide an immediate reward for customer investment in signing up.

- Can we make the customer experience seamless?

Given the quality of alternatives, a bad payment experience with a mobile wallet system could switch customers off permanently. Providers and retailers need to partner to make the customer experience as polished as it can be. Retail staff training, as Starbucks invested in when launching their wallet, is critical to helping customers through their initial learning curves.

Remember: wallets aren’t the only answer

As we’ve seen, making a standalone wallet work is challenging.

At Kin + Carta, we think most businesses should take a step back from a mobile wallet system, and consider alternative options to help their customers achieve their outcomes, unlocking new value for themselves at the same time.

For providers like banks, being the top card amongst other digital wallets can deliver increased transaction volumes. As consumers, we value frictionless experiences, and so it is the most convenient wallet that becomes the digital default. A strategy of ensuring ‘wallet primacy’ should focus on making it easy. It should also look at incentivising customers to add their card as the default in other wallets will pay dividends. In addition, issuing a digital copy of a card straight to a customer's wallet with token pre-provisioning allows customers to use their card straight away - without even having plastic in hand.

Banks should also be looking to add value pre- and post-transaction. The banking app should become a place where consumers can converge all their spending data, and deliver the next best action for customers to manage their financial well-being. PSD2 will open up new opportunities to aggregate data, and for banks to move beyond financial information into digital security and identity management.

Merchants, meanwhile, should focus on finding the wallet-worthy experiences in their proposition - or develop new ones. Where in the business model can value be added beyond just another way to pay? Quick, repeated transactions are where the most opportunity is likely to lie right now, but the changes to the retail environment offer an opportunity to reimagine what the store experience looks like. The availability of cheap sensor technology means that everything in store can be connected - stock, facilities, staff, and customers. With a mobile payment wallet to store payment information, the ‘checkout’ process could take place seamlessly in the background, letting customers conclude their experience on a high note.

Ultimately, the real winners are going to be the businesses who understand what outcomes their customers are trying to achieve, and how they can help them do that better than anyone else - whether that’s through wallets or not.

---