Banks have lent critical funding to businesses across countries and economies. In bad states of the world, when risks to a company’s cash flow or covenants materialise, one option for a lending bank is to enact an Independent Business Review (IBR).

At Kin + Carta, we have helped several banks conduct IBRs in recent years. A company director gets a call saying their business is under review. The process can then take anywhere from 4 to 12 weeks – and we have seen first-hand the pressures placed on a company and its bank relationships. It can result in the bank altering its lending terms, potentially adding capital if they believe the business remains viable, or even a withdrawal of funds.

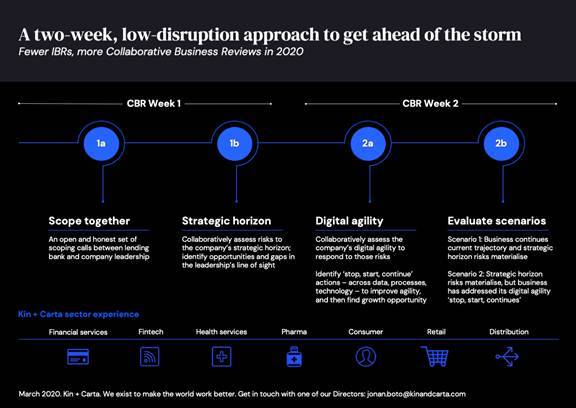

In today’s world, we believe that traditional IBRs are too zero-sum, and often too late in the game – for both the company and the bank.