Privacy as a differentiator

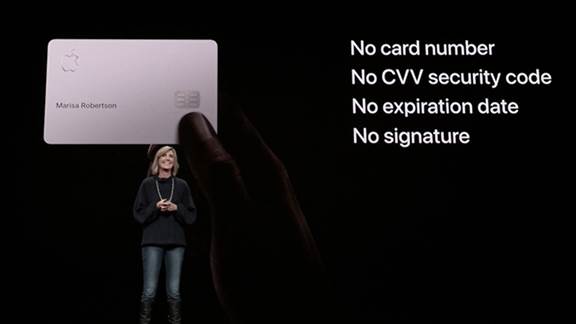

Privacy has been a key selling point for Apple over recent years. Indeed, privacy was a running theme of the 25th March keynote. “Apple doesn’t allow advertisers to track you” was a sentiment heard over and over again whether referring to what users watch or what they read. Given most of Apple’s profits come from selling hardware rather than advertising, they’ve made something of a statement of the fact that they don’t sell user data. This is a fact echoed in the Apple Card, with Apple claiming that they won’t know what users spend, or where they spend it. Apple’s partnership with Goldman Sachs to deliver the underlying payment infrastructure is a key enabler here. With Goldman doing things like fraud monitoring, Apple won’t need to know a lot of information it would otherwise need to collect to run an effective payment product.

The future of ‘Cash’

Apple ‘Cash’ has been showing up in patent filings for years, and with this launch we finally get to see it in the wild. For now, it’s just a repository for the simple cash-back feature of the new card. But it raises the possibility for an Apple owned fund-repository across your devices. This lends itself to a huge number of potential propositions over time. It could evolve into a payment method that Apple lets you fund from bank account and prioritises in the UX. ‘Cash’ could, in the future, be a platform that other financial products plug into for customers to choose from. The recently launched Goldman Sachs Marcus savings product seems like an obvious first choice here. ‘Cash’ could also be the place from which you manage and pay for all of Apple’s emerging subscription and app-mediated services. The ‘sell’ to merchants and financial services companies would be easy for Apple for any option - offering native UX enhancements, and potentially circumventing card network fees.