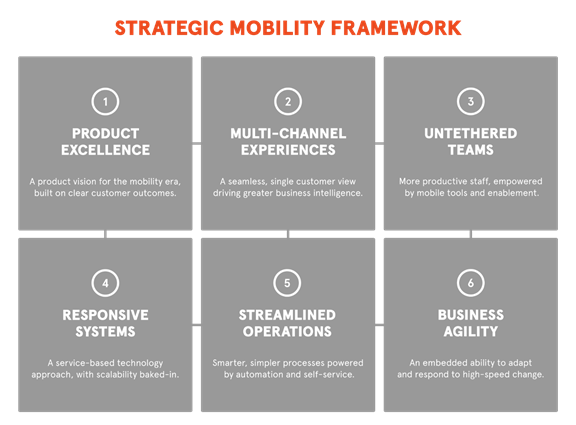

1. Product excellence

Get ready to embed App 2.0 thinking.

Legacy experiences - like simply replicating online banking in mobile banking - are no longer good enough. New players, like Monzo, are shaping breakthrough experiences by taking a mobile-native approach orientated around a deep understanding of the outcomes customers are trying to achieve.

This is App 2.0 thinking, and to successfully embed it, it’s essential to understand that an app isn’t a single product anymore. Instead, it is a multi-faceted service that customers ‘hire’ to complete particular jobs across multiple areas of their lives. As a result, modern mobile banking experiences need to flow, seamlessly, across devices, contexts, and interactions - ready to surface information at the most valuable time and place for the customer.

2. Multi-channel experiences

Stop thinking in siloed channels, and start thinking in journeys.

Too many customer experiences are shaped by the company's organisational structure, rather than the other way around. Seams appear between ‘digital’ experiences, branch activities and other channels resulting in friction, unsatisfactory handovers, and frustration.

Restructure your teams around the journeys customers take, by developing a deep understanding of a customer’s desired outcomes and the missions they go on to achieve them. The mobile application is perfectly placed to become the connective tissue between all touch points, acting as the window to your banking experience and dramatically enhancing the branch experience.

3. Untethered teams

t’s time to put control back in your team's hands.

Despite the changing role of each channel, personal, human interactions will remain an important part of the banking experience - particularly for certain customer groups and interactions. Expectations will rise as interactions become less transactional, less frequent, and centred on high-value advice.

To meet expectations, branch staff need to be empowered by the technology they use, with tools to help with processing, communication and smart, instant decision-making - as well as simplifying the flow of information by enabling staff to understand the processes to follow, improving service and reducing errors. Finally, banks must empower those closest to the customer by making them part of the process of developing and iterating these tools in partnership.

Customer outcomes and staff collaboration is one thing, but banks also need to achieve this vision technically, operationally and organisationally. Below we explore the foundational capabilities required to thrive.

4. Responsive systems

Build your technical stack to enable mobility.

Delivering on the experience identified above requires a new approach to selecting, developing and delivering technology. Foundational enablers are critical, and must be in place if banks are to deliver leading experiences seamlessly across multiple channels, devices and endpoints - for customers and staff.

At its heart, achieving this requires a fundamental rethink of core technology platforms - a daunting task given the current state of banking systems, which have typically been implemented on a massive scale, with the main focus on meeting regulatory demand rather than customer needs. This critical shift in focus will require banks to adopt polyglot technologies and emerging enablers, such as serverless apps and platform-as-a-service (PaaS).

A key foundation for change is a move by banks to enter the API economy. Personal banking products emit a wealth of information, which is invaluable to application developers and consuming systems - making developers customers, as much as more traditional end users. Retail banks will need to simplify and modernise banking service APIs to make the most of this opportunity: in the API economy, developers demand APIs that are simple, easy to use, easy to test, and mobile-optimised. A mature, efficient API strategy can, therefore, become a source of competitive advantage: creating preference amongst a customer base of engaged developers. Furthermore, a mature API strategy must take into account information layering and access control to sensitive data by authorised organisations. For example, efficient layering and control will allow a major mobile banking app developer to access the information they need. A smaller, independent developer, however - perhaps of a spending notification app - can access the same API, but will get restricted access to a much more limited subset of information.

Critical to success is the adoption of modern development practices and a closer engagement in the development community, breaking down the barriers of a closed, corporate environment that currently exists in retail banking. By committing to providing open source frameworks, libraries and example integration projects - practices that developers have come to expect from modern software organisations - banks will be able to create deeper rapport and relationships. This outreach, in addition to actively engaging the technology industry at large, can enable banks to evangelise their platforms and APIs in the forums that matter to the technical community. As the mobile ecosystem has proven, this open engagement will drive greater innovation, and prove essential if banks are to build a successful stack.

5. Streamlined operations

Deliver cost savings while refining the experience.

All businesses with a big physical store footprint need to undergo an organisational and cultural reset - repositioning stores from the status of crown jewels, to being an important but expensive part of a broad portfolio of touchpoints unified by the digital offering. Many have already begun this process, reducing branch and staff numbers.

However, there are a multitude of other opportunities to streamline operations using technology.

These opportunities should be assessed using analytics and in-store sensors to track how each service is currently utilised. Banks must reduce customer reliance on branches by providing customers with tools that shortcut purely transactional visits - paying-in and cashing cheques, foreign currency exchanges, and identification checks, for example. Additionally, low-value in-branch processes that currently require a teller can be automated by providing self-service - or, over time, become automated using intelligent services like chatbots. This reduces traffic, but more importantly will free staff for higher value interactions and better customer service.

6. Business agility

Turn your tanker into a speedboat.

A highly responsive approach, grounded in Agile principles and focused on reducing time-to-value, should not be the sole preserve of your technology teams. Financial services institutions need to reshape their organisations by adopting a leaner, more agile approach beyond the core technology group.

Regularly releasing software and getting feedback from users in shorter, faster time intervals - whether such users are customers, branch staff or others - brings the organisation closer to the people they serve. These regular feedback loops provide a vital market-sensing capability that previously would get shut away in a drawer with last quarter’s market research report.

Crucially, this organisational approach injects higher speeds into proposition and product development, allowing the organisation to develop a sustainable frontrunner position. The organisation learns to test, and experiment, adapting to change at pace - resulting in an altogether faster, smarter, and safer process that minimises both waste and risk.