Card issuers have long assumed that disputes are too complicated to be digitally self-serviced. This assumption is wrong. Card issuers have the opportunity to improve the dispute experience for their customers, and that opportunity starts the moment the cardholder realizes something is wrong. In fact, the dispute experience provides an opportunity to actually make the customer happier than if there was nothing to dispute! Happy customers aren’t the only reason to improve disputes: experiencing fraud on a card can cause the cardholder to reduce spend on that card. However, the faster and easier you can resolve their dispute, the more likely they will stay your happy customer. Let’s walk through how card issuers can improve the dispute experience while keeping both their customers and their bottom line happy.

CX focused service recovery for card disputes

In many situations involving service recovery - the problem itself became the catalyst for the creation of even greater trust as the companies took issues head-on and worked through the difficult problem in a way that restored confidence.

Stephen Covey American educator, author, businessman, and keynote speaker.

Make it easy, make it digital

Imagine you are checking your bank’s app and you notice a transaction that you didn’t make. You hunt for details on the transaction, then, like most people, you call your bank to dispute this charge. This is the problem with today’s dispute experience.

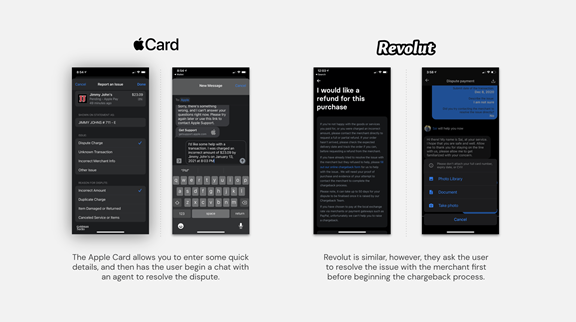

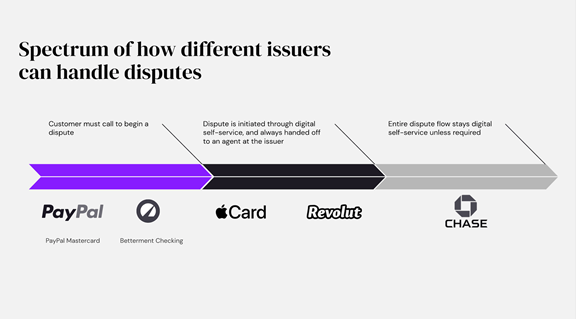

It too often requires talking or chatting with an agent at the card issuer. There is not a single question that the agent will ask you that you couldn’t have answered in a digital form and you can bet that the agent is inputting your answers into their own digital system. Banks have usually operated under the assumption that the dispute flow is too unwieldy to be a completely digital self-service experience, so they have put an agent in the middle of it.

This assumption is no longer true. Cross-generation comfortability with smartphones have raised digital self-service expectations. Crafting the right digital dispute experience that exposes just enough of your dispute process and asks just enough information of the cardholder is possible for your business. The card issuers need to understand key pieces of information, such as if the consumer is disputing a fraudulent transaction or another type of dispute (dollar amount, problem with product or service, or gray charge). However, consumers are unable to easily understand if there was fraud, and typically only understand that something is wrong with a recent purchase they made. This is why you need to implement the right digital dispute experience that innovates on your business processes.

Ripe for innovation

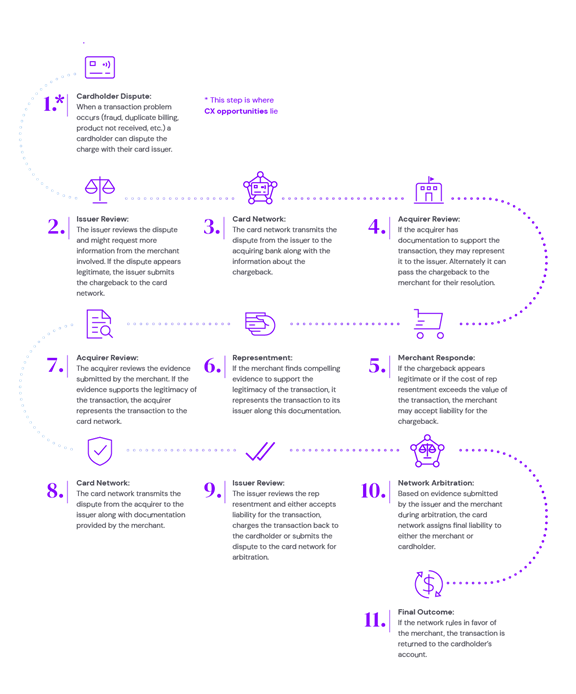

The dispute journey is complicated because it is highly regulated and involves many stakeholders: the cardholders themselves, the card issuer, the card network, the merchant, and the acquirer. There has been low pressure on credit card companies and banks to improve the dispute experience because people generally blame the merchant when filing a dispute. Nevertheless, cardholders bypass merchants and go directly to their issuer in 76% of cases when they see something wrong with a transaction.

Banks and credit card companies have not tried to differentiate from their competition with an easy dispute experience. This is because they have had success converting prospects with account opening bonuses, cash back, promotional interest rates, and slick digital experiences. Even other cardholder benefits like Price Protection, Purchase Protection, and even Rental Car insurance coverage are more often advertised than the dispute experience.

However, expectations for the dispute experience are being raised by neobanks and fintechs, and card issuers cannot rest on their laurels. Disputes are costly for card issuers, a slow experience for cardholders, and a usually agent-driven experience. All these factors make it ripe for innovation.

Start at the beginning

Begin by helping your customer triage the dispute. Provide a simple digital dispute experience using pre-filled fields and keeping as much of it digital as possible. From the cardholders’ perspective, an all digital self-service experience means the resolution can happen faster and can be handled without finding the time required for a phone call with their bank or credit card company. From the issuers’ perspective, the more digital the dispute is, the less it will cost to resolve it.

We believe that the opportunity for improving the dispute experience for customers starts the moment when the cardholder realizes something is wrong. That moment is likely while they are reviewing their transactions on the website or app of their bank or credit card company.

Within the Transaction Detail view on your app or website, provide an option for the cardholder along the lines of “I need help with this transaction” to begin the dispute experience. In this flow, you can ask the cardholder questions that help you as an issuer determine which of the four types of disputes it falls within. Don’t encumber the cardholder with your back office workflows, ask just enough questions to categorize and understand the dispute. Designing this experience for maximum simplicity requires working across legal, risk, business, product, and other teams, so make sure to have a clear vision to march towards.

The key to service recovery

Innovative card issuers are winning at disputes by prioritizing digital self-service. Digital self-service scales with less cost than agents resolving disputes over the phone. It also provides a faster resolution and better experience to your cardholders, which is critical to keeping their business in the long-term. If you can enable cardholders to begin a dispute on a noisy bus ride on the way to work, or while multitasking during their day, and instantly issue credit for the disputed amount, they are going to be a much happier customer, and more likely to keep spending on your card.

The key to service recovery is to think about the complete customer journey that your customers are going through, including before, during, and after the dispute process. Do not put customers through the unnecessary anxiety of waiting until their lunch break to spend 15 minutes on the phone with an agent who will ask all the same questions they could’ve answered through digital self-service hours earlier.

People who experience disputes are going to have a negative association with that card which will make them less likely to spend using it. The faster and easier you can resolve the dispute, the more likely you will be to recover from a negative experience with that customer. The moment a cardholder learns their money will be credited back to them is a moment of relief, yet no card issuers celebrate this moment with anything more than a tersely worded official document or a scripted response from an agent. This is a wasted opportunity to empathize with customers.

Even though the dispute wasn’t the issuer’s fault in the first place, your customers expect you to resolve the issue as quickly and painlessly as possible.

Jared Johnson Director of Digital Strategy, Kin + Carta

Dispute Best Practices

- Allow the user to submit a dispute from the transaction details screen on the web and mobile — do not force them to call to initiate the dispute since much of the initial questions can be made into a simple digital form that can be passed to an agent later in the flow if needed.

- Try to help resolve a dispute before it starts. Provide the user an explanation of why the transaction may seem strange (merchant name could appear differently in the transaction than the merchant’s actual name, did a friend use your card, have you provided enough time for the transaction to complete, etc.) before you begin the disputes flow.

- Provide different flows that funnel users to flows aligned with fraud vs. errors. Do not ask the user if there was fraud, but instead ask if they did not approve the transaction vs. if the amount charged was incorrect to help the user determine if this is dissatisfaction with the merchant’s goods/services, or if there is actual fraud.

- In cases of a small disputed amount for customers in otherwise good standing, do not open an investigation, but rather immediately credit their account the disputed amount. Do the calculation to determine when it is cheaper to simply credit the disputed amount, instead of investigating or handing it off to the card network to investigate.

How to get started

-

Map out your existing service blueprint for disputes. Understand both what the customer journey is as well as the process the business uses that is invisible to the customer. A team with service design expertise is able to aid you greatly in this process.

-

From here, begin to blueprint the ideal future. Take into account the level of risk your organization is willing to take on, and the digital acumen your organization.

-

Identify a small subset of customers that you can A/B test the new process with. Start small to ensure that your new disputes process works seamlessly, then roll it out to more customers as your confidence grows in the new process.