Software continues to eat the world and insurance is next on the menu. Most, but not all of the low hanging fruit has been plucked. While the laggards reach for what remains, the innovators set their sights on the more transformational opportunities that emerging technology unlocks. These transformational opportunities require much more than human-centered design and empowered IT teams; they require risk tolerant, outcomes-driven leaders who are willing to test and experiment with new business models and insurance technology with a competitive edge, not just with new app features.

The shifting landscape of insurance technology

2020 to 2030 will see insurance firms...

As the tech landscape continues its acceleration, every business unit of insurance companies, for example, product, risk and claims, will need to find transformative uses of insurance technology to not become a laggard. We discuss below what some of these transformative examples look like for insurance leaders.

Product development

Understanding evolving customer needs to design and develop new insurance technology products and services.

Technology is driving new kinds of insurance needs.

As technology ushers new kinds of assets and behaviours, and blurs the definition of private and commercial activity, new insurance needs are continuing to emerge.

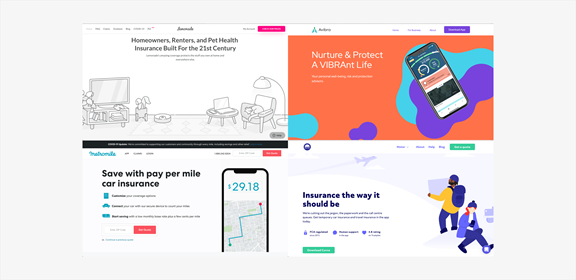

- Lemonade enables homeowners and renters to go from uninsured to covered in a few minutes through a slick digital self-service experience. By targeting customers in big cities, Lemonade is able to ask fewer questions than other insurance companies, while providing a more comprehensive digital self-service experience.

- Avibra uses machine learning to track your habits and let you know what you are doing well in areas that span across health, finances, career, relationships and your community. In the process, your life insurance coverage grows weekly with your positive habits.

- Metromile provides insurance coverage to Uber drivers for when they’re in between fares by using a telematics device to track when they’re driving ‘off the clock’.

- Cuvva provides carshare users with on-demand, pay-by-hour insurance coverage for short-term vehicle protection.

New data enables insurers to design better products.

Sensor data coupled with the right analytics, provides more complete behavioural, and needs-based, pictures of customers - allowing insurers to develop more holistic value propositions.

Pricing and underwriting

Capturing and analyzing customer and asset data to accurately price and assess risk.

Sensor data is enabling new ways for insurers to assess risk.

As sensors and devices proliferate, they generate a vast wealth of sensor data about individuals, their belongings, and ultimately, their risk - allowing for more accurate risk assessment and fairer pricing.

- Tapping into a car insurer’s data repository, usage-based pricing models like pay-as you-drive (PAYD) could be based on driving behaviour, routes traveled, the claim history for a stretch of road, current weather patterns, and even the other drivers on that route.

- Farmers who use IoT devices to improve crop yield could share the sensor data with their insurance company, ensuring they receive the right coverage for the current conditions, be it one of drought, flood, or average weather.

Sales and distribution

Attracting customers, helping identify coverage needs and selling insurance products.

Insurance is being unbundled and sold on-demand via mobile.

The ubiquity of mobile devices means customers now expect to engage via mobile with companies in all sectors - even insurance. Startups are seizing the opportunity by unbundling insurance to make it more affordable, flexible and more convenient to purchase on-the-go.

- Trōv allows customers to protect just the things they want, exactly when they want, entirely from their smartphones.

- Lemonade offers a strong price and great on-boarding experience to woo young people into buying renters insurance.

- Sure provides ‘episodic’ insurance that allows people to quickly and easily buy coverage when they need it - e.g. before boarding a plane.

- Cuvva allows car renters to purchase short term vehicle insurance on the go. Instead of filling out long application forms, customers can simply send a selfie, a picture of their license and a picture of the vehicle they’re about to drive.

- SPIXII is an AI insurance sales agent dedicated to making insurance purchases quicker, easier and more personal through a mobile messaging interface.

Risk management

Continuously monitoring risk and coaching and advising customers to reduce risky behaviour through insurance technology.

Sensor tech helps shift insurers to a proactive business model.

Sensor data technology allows insurers to shift away from passively estimating risk and reactively paying claims, to proactively using predictive analytics to prevent losses and better manage risk. Health insurers monitoring policyholders’ health in real-time could alert them to any early signs of illness. Insurers would benefit from reduced liabilities and could offer lower premiums in return.

IoT devices allow insurers to influence customer behaviour.

Insurers are leveraging IoT-enabled devices to nudge, reward and educate customers to change their behaviour and, in turn, lower their risk profiles.

- Insurethebox uses vehicle telematics devices to record mileage and driver behaviour, rewarding customers safe drivers.

- Vitality provides members with an Apple Watch so they can earn points via exercise to lower their monthly repayments.

- American Family has begun offering discounts on home insurance if customers invest in IoT devices such as smart thermostats and security products.

Policy administration

Seamlessly handling changing customer circumstances and policy administration tasks.

Interactions can flow seamlessly across devices and contexts.

Insurers are turning to new platforms and technologies like wearable computing,artificial intelligence and voice interfaces to better serve customers in the contexts they're in.

- AXA is investing in Amazon’s Echo as a gateway for home services like AXA Assistance, creating an always-on, direct communication link between customers’ homes and their insurer.

- MetLife launched a digital self-service platform on WeChat to attract younger Chinese customers.

- Safeco allows people to get answers to common questions and find a nearby agent to help tackle tougher queries

- Brolly is a UK-based personal insurance management app and broker, allowing users to manage their policies in one place and understand where they have duplicate or missing coverage.

Claims processing

Analyzing events and processing information to manage insurance claims and prevent fraud.

Mobile allows for faster, more personal, on-the-go claims.

Using conversational interfaces, pattern spotting and machine learning, insurers can handle customer enquiries and sort through vast troves of data to dramatically reduce claim processing time and fraud risk.

- Trōv uses a chatbot to walk their customers through the claims process.

- Lemonade allows customers to file an insurance claim in 2 minutes via their smartphone app.

Blockchain makes insurance smarter, streamlined and secure.

Blockchain could allow insurers to develop ‘smart contracts’, which trigger payments automatically when specific policy conditions are met (and validated), without customers having to make a claim, reducing administration costs, improving customer satisfaction, and minimising fraud.

- Travel insurance companies could use publicly available airline data to pay out automatically if their customer’s flight is delayed or cancelled.

- The transparency of blockchain could also prevent fraud by rejecting multiple claims for one accident because the network would know if a claim had already been made.