From day one, the product vision and timescales meant that unification and collaboration were crucial to enable success for a co-located Bankline Mobile team.

A common goal, vision and ways of working forged the bond between Kin + Carta Create and our multidisciplinary co-workers at NatWest, unifying different disciplines from across the bank – from technology, change, design, product and the business.

Multiple viewpoints can make for unique challenges in a co-located team. Our self-organisation and honest collaboration between junior and senior colleagues ensured that we could focus and refocus to deliver the first beta release in just 12 weeks.

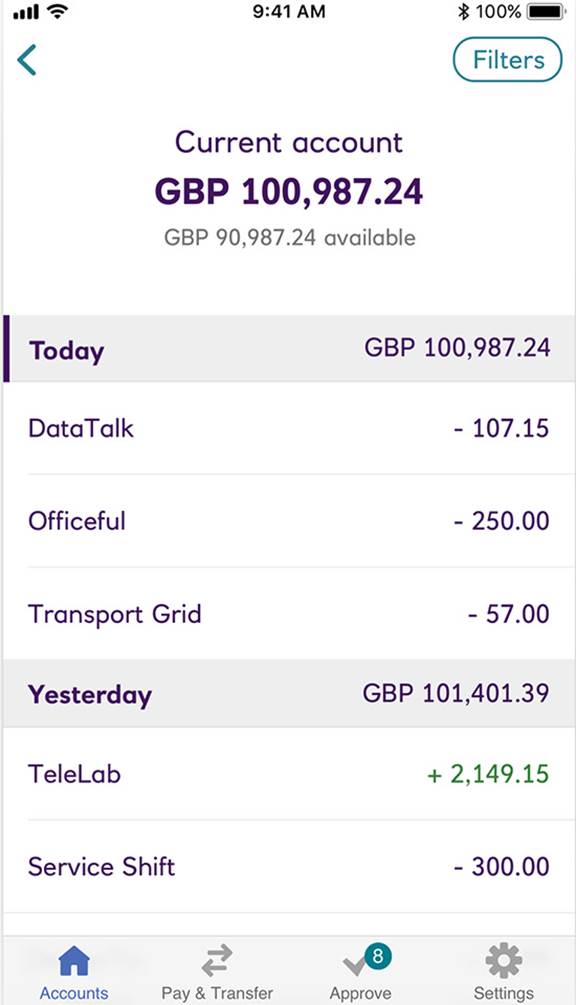

This not only minimised waste, but also maximised the impact the app had on stakeholders, other digital teams at NatWest and RBS and, of course, their customers. The team shared responsibility for quality assurance, deploying extensive testing automation and continuous integration throughout the development process.

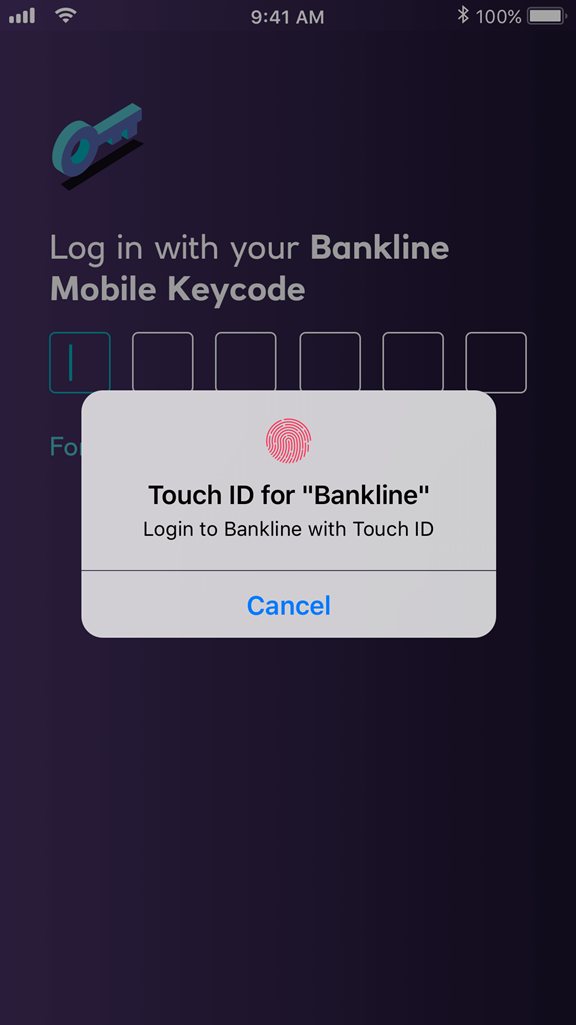

How do we know this worked? The security team at NatWest vetted it against their global security standards and its robustness saw it through without a hitch. What’s more is that the crash-free rate remained at 99.8% from the day of its first iPhone beta release through to its first six months in the App Store.

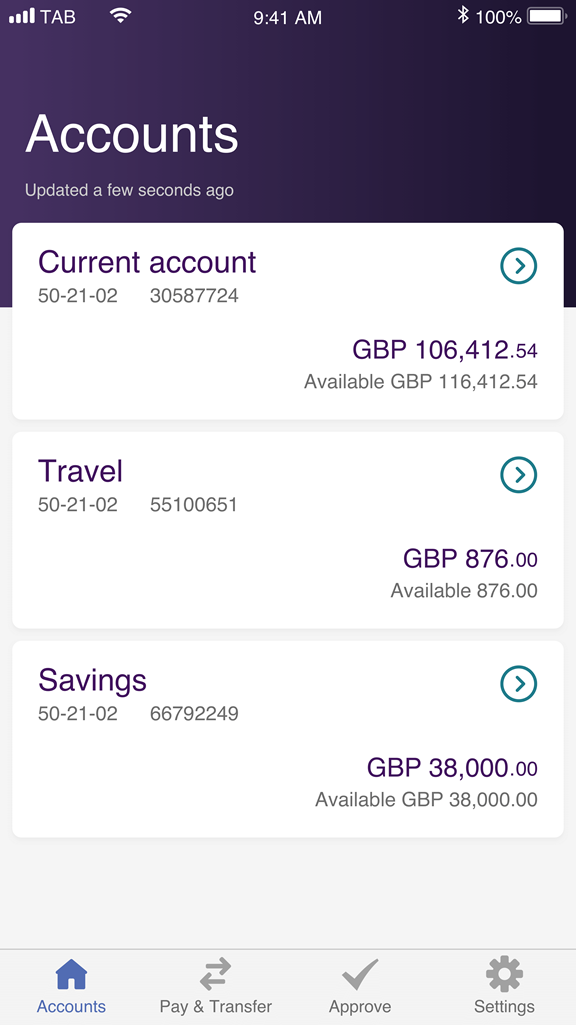

More than 20 app updates were collaboratively built throughout 2018 before Bankline Mobile was launched to the public on iPhone in November 2018 and on Android in March 2019.